Rob explains how to calculate the financial freedom amount you need to live comfortably each month. This could mean in retirement or in an emergency financial event. Also, we discuss the process of reviewing how much you need for your security fund, and auditing your investments.

Financial Freedom Amount – Finding it through your Profit and Loss Review

Financial Freedom Amount – Finding it through your Profit and Loss Review

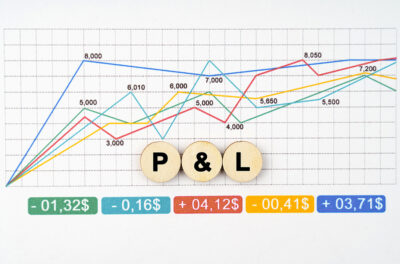

Rob starts out reviewing three levels of living standards: the basic level, vitality level, and your financial freedom amount. To determine how much you need to live on day to day, you must perform a personal P&L review with your own bookkeeping software. Whether it’s Quickbooks or another platform, it should have tools built in to generate profit and loss statements easily.

He then presents the concept of “grateful business expenses”. If he didn’t own a business, he couldn’t write off certain expenses, such as his cell phone bill and medical expenses. Make sure those write offs are part of your report!

Next, the discussion turns to your security fund. Your financial freedom amount must take into account money you’ll need in case of disaster. Rob recalls the day that the COVID-19 pandemic shut down all non-essential businesses. Many people were not prepared for this scenario, and we are still feeling the effects of it today. You must determine your own emergency fund number by months of income. Rob’s wife Claudia’s comfort lies with 18 months of income in the bank.

After that, you need to examine your investment funds. Are you stacking cash you don’t want to touch, but can afford to if need be? In an absolute emergency, you can borrow from your kids’ education fund, albeit with penalties.

Take all of these factors in when calculating your financial freedom amount.

Join Our Community

Do you own multi-family properties? If not, do you aspire to one day? Then you should consider joining our online discussion group, the Addicted To Life Community! Each month, Rob Rowsell will teach you what you must do in order to build wealth in the real estate business. It’s not as easy as it looks! Property taxes, liens, and legal fees can all be hard to navigate, so having a successful guide in your corner like Rob is a must! Enroll today!

Investment Performance Review – Time and Funds

Investment Performance Review – Time and Funds Advantages of an In-House Bookkeeper

Advantages of an In-House Bookkeeper Backend Equity Property Investment

Backend Equity Property Investment Using Strategic Depth to Grow Your Assets

Using Strategic Depth to Grow Your Assets